Frequently Asked Questions

Make sure you know your account number and have your current mobile number and email address on file with us.

New Online and Mobile Banking

What is new in the digital banking system?

We think you will enjoy the convenience of:

- Consistency across all devices

- Logging in with two-factor authentication

- Adding notes, tags, and pictures to your transactions

Plus, check out what’s coming to our new mobile app

- Easier access to credit card, mortgage, and bill pay information

- Manage external transfers, mortgages, and multiple account profiles

Why did digital banking change?

You spoke and we listened. We are now simplifying our online and mobile banking into one platform. Our new digital banking experience provides convenience with enhanced security, new features and functionality.

Will I need to download a new app with the new digital banking?

Yes. The Apple app is available on the App Store and the Android app is available on Google Play.

Do I need to re-enroll in digital banking on the new system?

You will need to re-enroll in digital banking. Please refer to "Logging into Online Banking" below.

Logging In

Logging into Online Banking

How do I access digital banking?

You can access the new digital banking and your account on a desktop, laptop, mobile phone, or other internet-accessible device. Simply enroll with a new login and password. There are two access points:

1) Visit our website and click "Access My Account" to get started

2) Download the NEW mobile banking app from the Google Play or Apple Store

Note: You will not be able to access the website via old bookmarks or the previous mobile banking app.

What is 2-Factor Authentication and why is it used by the digital banking system?

Two-Factor Authentication is a security measure that allows you to request a one-time access code to log in to digital banking. The code enhances the security by creating an added layer on top of your unique username and password. This security process helps to verify you and better protect your credentials and the accounts you can access.

When I log into digital banking, do I need to get a confirmation code every time I log in?

No. Check the “Don’t ask for codes again on this computer” box if you do not want to receive a confirmation code or phone call each time you log in. If you prefer to input a confirmation code with each use, you can leave the box unchecked or use the 2-Factor Authentication app to deliver the code.

Note: If you ever want to remove a device and reset your security settings, you can change them in settings once logged in to digital banking.

How can I log in to digital banking if I can't get a verification code through text message?

Two-Factor authentication uses a unique one-time access code to verify identity and log on to digital banking. If you are unable to receive text (SMS) messages, you can choose to receive your access code via a phone call.

- On the verification code screen click Try another way located beneath the Verify button

- Select Phone Call and click Next

- You will receive an automated phone call that will provide your access code (Have a pen and paper ready)

- Return to the verification code screen

- Enter your access code and click Verify

If you are still having trouble, contact the Credit Union to ensure we have the correct phone number on file. You can authentication applications like Authy, Google Authenticator, Microsoft Authenticator and others.

Can I use an email for two-factor authentication?

An email and a phone number are required for the two-step authentication. The one-time access code will be sent via text or phone call. The phone number must match our records for the additional security layer to work correctly.

Why am I getting the digital banking error: "Your account needs attention"?

This error is present during the log in process and typically means that your account has been locked. This can happen for a variety of reasons but is easily resolved. You can recover your account by going through the "Forgot?" steps.

Why am I getting the digital banking error: "Please verify your information and try again"?

This error is present during the log in process and typically means that your credentials didn't match our records. Try entering your credentials one more time. If the error persists, please contact us via phone or chat for further assistance.

Why am I getting the digital banking error: "Oops: The information you provided doesn't match what we have on file."?

This error is present during the log in process and typically means that your account information does not match our records. Please contact us via phone or text to confirm we have the correct phone number and username on record.

I'm not able to log in to online banking when I click on the login button.

You need to clear your cache in Chrome to remove all cookies. Here's how to clear your cache and cookies on Google Chrome.

Why am I getting the digital banking error: "Incorrect phone number"?

This error is present during the enrollment process and means that the phone number you entered does not match the phone number we have on file. If you have an alternative phone number, you can try again. If you would like to update your phone number in our system or need other assistance, please contact us.

Why am I getting the digital banking error: "Does not meet username or password requirements"?

This error is present during the enrollment process or when updating credentials. Click on "Show Rules" below the username and password field to see the credential requirements.

Why am I getting the digital banking error: "It looks like you've already enrolled"?

This error is present during the log in process and typically means that our records show that you have previously created an account with us. If you forgot your username and password, on the log in page click Forgot? Follow the steps to recover your account.

I can't remember my username name or password

You can recover your account by going through the "Forgot?" steps.

Transfers/Transactions

How do I make a transfer between my accounts in digital banking?

To transfer between your Credit Union accounts in digital banking:

- Log In

- Click Manage Payments > Transfers > Make a Transfer online or tap the slideout menu > Transfer > Make a Transfer in the mobile app

- Select your To and From account and amount

- Click More Options to change the frequency and date if desired

- Click Submit

Will my previously created scheduled transfers still work in the new digital banking system?

Yes, all existing scheduled transfers in the previous digital banking system have been moved to the new system.

Where can I view pending transactions on my account?

- Log in

- Select the account you are needing to view

- To view all account activity, select Transactions in the mobile app

How do I search for transactions in digital banking?

Account transactions can be searched in digital banking by date, tags, etc.

- Log in

- Click Accounts

- In the Accounts section, select the account you would like to search

- In the Activity section, select the magnifying glass icon

- Click on the Search and sorting options to open Advanced Search in digital banking

- On the Advanced Search window, you can select specific search filters and select Search

- Log in

- Select your account you want to search

- Select Transactions

- Tap the magnifying glass icon

- Tap the GEAR icon to use Advanced Search options

How do I add a tag, note, or image to a transaction in digital banking?

You can add notes, tags, and images to any transaction inside of digital banking. To begin:

- Log in

- Click on any account

- Click on Transactions (in mobile)

- Select the Transaction you wish to edit and pull up the transaction’s details page

- Click on the appropriate icon for one of the following:

- Add Tags

- Add Notes

- Add Images

- Follow the on-screen prompts to update the transactions

- Close the transaction detail page or tap < Transactions in mobile

Any tags, notes, and images attached to transactions will be accessible on all devices when you log in to digital banking in the future.

How do I download transactions in digital banking?

Account transactions can only be downloaded in digital banking (excluding the app).

- Log In

- Click Accounts

- In the Accounts section, select the account you like to download transactions for.

- In the Activity area, select the first icon next to the print and search icon.

- On the Download Activity window, select the Date range and File Type and click Download.

How do I print transactions in digital banking?

Account transactions can only be printed in online banking.

- Log In

- Click the Accounts tab

- In the Accounts section, select the account

- On the Activity section, select the printer icon. Only transactions that show in the Activity section will print.

- A print screen appears with a print preview and print configuration options.

- Using the dialog, configure the print settings and select Print.

Bill Pay

What is Bill Pay?

Bill Pay allows you to pay anyone, anywhere right from your computer or mobile phone. There is no limit to the number of bills you can pay, and this service is free to all members with a checking account. Bill Pay is offered through digital banking.

How do I pay a bill in digital banking?

You can use digital banking to pay a bill or pay a person.

- Log in

- Select Manage Payments or Tap Pay under your account in mobile

- If it is your first-time using Payments, it will ask you to enroll, click Enroll

- Select Pay a bill or Pay a person (online only)

- Select the merchant or person you would like to pay

- Select an account to take funds from, and then input the Amount

- If you would like to set the date for the payment, Select More options and select the desired date

- Select Submit

How do I pay a person (with Bill Pay) in digital banking?

You can use digital banking to pay a bill or pay another person.

- Log in

- Select Member Transfer

- If it is your first-time using Payments, it will ask you to enroll, click Enroll

- Select Pay a person > Person to pay (To add a new person, select Add another person and fill out the necessary information) or Select the person to pay in mobile

- Select an account to take funds from, and then input the Amount

- If you would like to set the date for the payment, Select More options and select the desired date

- Select Submit

Are my bill payment accounts being transferred automatically or do I need to set them up again in the new digital banking?

Bill payment accounts will be automatically transferred and do not need to be set up again.

Will my scheduled bill payments carry over to the new digital banking?

Any scheduled bills will be paid as scheduled and scheduled payments will carry over to the new digital banking experience.

Manage My Credit Card

How do I view transactions and statements?

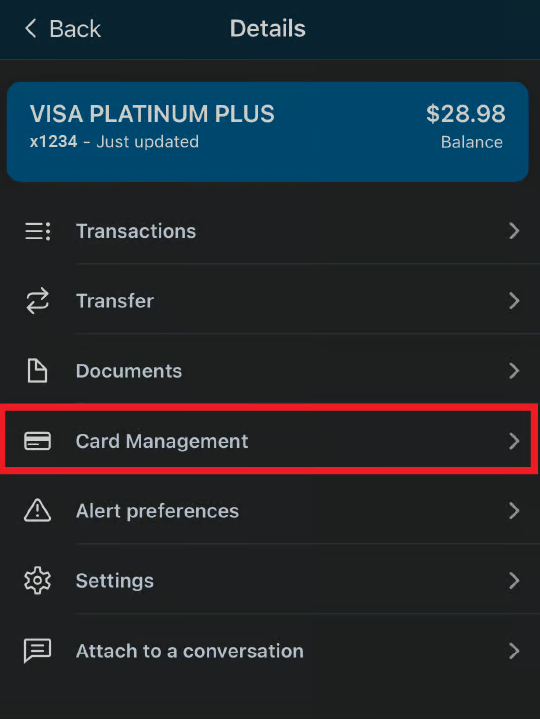

- To access your credit card information, simply press the "Card Management" button on your credit card profile in the online banking application.

How do I pay my Credit Card?

Messages

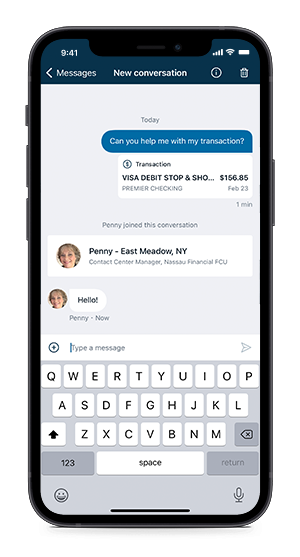

How do I send a message in digital banking?

Whatever device you are on, it's easy for you to start a secure conversation with the Credit Union:

- Log in to digital banking via the Login button on the website or via the mobile app.

- From a desktop, click on the Messages button in the upper right-hand corner of digital banking or select Conversation from the dashboard of mobile banking.

- Click Start a conversation or click the conversation icon on mobile.

- Type your message and click Send.

A member service consultant will respond shortly. To assist you, we have created a short video:

Transacting with another Financial Institution

How do I set up a new transfer to or from another institution?

You can make transfers between your Credit Union accounts and other financial institutions once an external account has been verified.

To add an external account:

- Log in to Digital Banking

- Click Transfers

- Click +External Account to set up a new linked account

- Confirm a deposit amount into your other financial institution

- Finally, schedule a new one-time or recurring transfer

- Log in and click the MENU icon in the upper left corner

- Click Settings

- Click External Account to set up a new linked account

- Confirm a deposit amount into your other financial institution

- Finally, schedule a new one-time or recurring transfer

Please note: Transfers to another financial institution may take 3-5 business days to process.

Alerts

Will my previously created account alerts work in the new digital banking system?

Alerts will need to be re-entered in the new system. To set up alerts in digital banking:

- Log in

- Select the account you would like to set up an alert for

- Click Alert preferences in the menu or Manage alerts in mobile

- In the Balance alerts section, select Add alert.

- Select Above or Below, and then input a dollar amount.

- In the Alert/Notify by field, select Email, Text message, or In-app message.

- Select Add Alert to save the alert

- Repeat steps for Transaction alerts

How do I delete an alert in digital banking?

Alerts can be deleted at any time in digital banking.

- Log in

- Select the account you would like to edit up an alert for

- Click Alert preferences in the menu on mobile

- Under Alerts

- Click Edit next the alert you would like to change

- Click the Trashcan icon or click Remove in mobile

How do I edit an existing alert in digital banking?

Alerts can be edited at any time in digital banking.

- Log in

- Select the account you would like to edit an alert for

- Click Alert preferences in the menu or Manage alerts in mobile

- Under Alerts

- Click Edit next the alert you would like to change

- Change your criteria for the alert

- Click Save

eStatements

Will I need to re-enroll in eStatements with the new digital banking?

You will not have to re-enroll in eStatements. If you have not yet enrolled in eStatements, we encourage you to do so. The new digital banking site will make accessing your account and statement information easier than ever.

To assist you, we have created this instructional video with all the steps to enroll in eStatements:

How do I view my account statements and tax documents in digital banking?

Account statements and tax documents can be downloaded from digital banking. These are only available for accounts already enrolled in eStatements.

- Log In

- Click on any account listed

- Click on Documents from the Account Details page in the options menu

- Statements and Taxes will be listed for each year available

Remote Deposits

How do I make a mobile deposit in digital banking?

Mobile deposit is available for all checking accounts. Mobile deposit can only be done through the mobile app.

- Log in

- Select Deposit under your checking account OR select Deposit Check from the slideout menu in the mobile app

- Once your request has been processed and approved, tap Deposit a Check

- Enter the check amount

- Tap Continue

- Select the account to deposit to

- Take a picture of the front of the check and tap continue

- Take a picture of the back of the check and tap continue

Are there limits on the dollar amount and number of mobile deposits I can submit?

These limits include a daily dollar amount and number of items deposited daily. If you have specific questions, come in or call the Credit Union.

What should I do with my checks after using mobile deposit?

You should retain the check for thirty days after the deposit has posted to your account. After that time, you may shred it.

Card Management

How do I block my debit card in digital banking?

Blocking your debit card is easy in digital banking. It's just as easy to unblock it as well!

- Log in

- Under the Card Management tile, click the toggle slider to turn the desired card off

- If you wish to turn the card back on, simply click the toggle next to the blocked card to turn it on

Reorder Checks

How do I re-order checks in digital banking?

Checks can be re-ordered through digital banking.

- Log in

- On the dashboard click on your checking account from the account list

- On the account details page, from the options section click on the Reorder checks link

Updating Information

How can I change my phone number, email address, or primary address in digital banking?

You can update your phone number, email address, or primary address in digital banking.

- Log In

- Click on the User Profile icon and click Settings

- Click Edit next to your phone, email, or address

- Verify your password

- Edit your contact information

- Click Save

How do I change my username or password in digital banking?

You can change your username or password at any time in digital banking.

To change username:

- Log in

- Select your username icon in the top right corner or menu in mobile banking

- Select Settings and then select Security option on the left side menu

- In the Username field select Edit

- Enter your current password when prompted

- Change your username and select Save

To change password:

- Log in

- Select your username icon in the top right corner or menu in mobile banking

- Select Settings and then select Security option on the left side menu

- In the Password field select Edit

- Enter your existing password, and then enter a new password

- Select Save

To change passcode on Mobile:

- Log in

- Select your username icon in the menu in mobile banking

- Select Settings and then select Security option

- Select Change Passcode

- Enter your existing passcode, and then enter a new passcode

- Select Save

How do I rename or personalize an account name in digital banking?

You can rename any account you are primary on in digital banking.

- Log in

- Select an account from the Accounts section

- Select Settings from the options menu

- Next to the account name, select Rename

- Type the new name, and then select Save

How do I change the order my accounts are displayed in digital banking?

You can rearrange the order your accounts display in digital banking to reflect the sequence you want.

- Log In

- From the Accounts menu click Organize Accounts

- Drag and drop the accounts to rearrange the order

- Click Done

Misc. Online

Which Internet browsers can I use to access my accounts online?

Recommended browsers (current major release):

- Microsoft Edge

- Firefox

- Safari

- Chrome

Note: Microsoft no longer supports Internet Explorer versions older than 11.0, and security updates are not available. Please download one of the browsers listed above.

Safari versions below 10.1.2 are not compatible with the initial log in process. To complete the initial log in process, upgrade to the latest version of Safari, or use Chrome or Firefox.

The following types of browsers and tools are not recommended for use with digital banking:

- Beta versions

- Embedded browsers within Personal or Commercial Financial Management Software

How do I log out of digital banking?

When accessing on a browser, click on your user icon at the top right-hand corner, or select your name at the bottom left-hand corner of the screen and select “Sign Out”. You will be taken to our website homepage and your session will be closed.

What is the inactivity time-out period for digital banking?

For your security your account will time-out after 10 minutes of inactivity.

Misc. Mobile

How do I change my profile photo in mobile banking?

- Tap the slideout menu, and then select Settings.

- On the Profilescreen, select the PENCIL next to the end-user profile image.

- Choose to use an existing photo or use the device's camera to take a new photo.

- On the Move and scalescreen, adjust the photo placement within the frame as desired.

- Select Done.

How do I log out of the mobile app?

Tap the menu icon at the top-left of the screen and tap the user icon at the bottom of the menu. You may select "Sign out" which will bring you to the login screen of the Mobile Banking App.

When you are using the mobile app, there is not a log out button to push. You can exit the app by going to a different app or your home screen. Each time you navigate away from the app, your active session is ended, which serves the function of a log out button. When you navigate back to the app, you will be asked to re-authenticate, and if you have quick access features such as FaceID, TouchID, or passcode log on, you can gain access quickly each time.

If you want to remove the connection between your device and your account altogether, you can go to the Menu > Settings > Remove Profile. This will remove all association between your account and the mobile device and app you are using. Each time you attempt to access the app after this, you will have to put in the full username, password, and 2-Factor authentication to authorize your account on that device.

What minimum software versions are required for the mobile app?

The Apple mobile app requires a minimum version of iOS 12. The Android mobile app requires a minimum version of Android 6.0.

Can I customize my mobile banking dashboard on multiple devices?

Yes, you can!

You can customize a unique Dashboard set up for each of your devices. Changes to one device's Dashboard layout will not affect the arrangement on other devices.

MyFinance 360

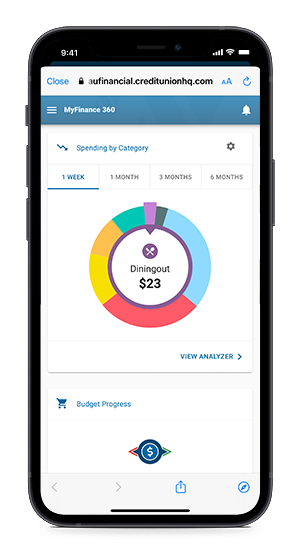

What is MyFinance 360?

MyFinance 360 is a free online Financial Management Tool that allows you to track spending, set budgets and plan your financial future by combining information and transactions from all of your financial accounts, both inside and outside the Credit Union.

How do I access MyFinance 360 in digital banking?

MyFinance 360 is a Personal Financial Management tool that you can use online or from your mobile device. To access:

- Log in to either digital or mobile banking

- On the dashboard click on any account to go to the account details page

- On the account details page, from the options section, click on the MyFinance 360 link

If you have not previously used MyFinance 360, your Credit Union accounts will automatically sync and you can begin tracking spending, setting budgets, and planning your financial future.